Fitment Factor Calculator

Estimate the 8th CPC fitment factor based on current DA & General Hike or the Aykroyd Approximation method.

Fitment factor (or fitment percentage) is the main thing that matters when projecting the expected salary increase under the 8th Pay Commission for Central Government employees. Below is a calculator you can use to estimate the fitment factor based on the most widely followed approaches, the Pay Commission may adopt (at least to some extent) for salary revision.

Scroll down to read the about the fitment factor calculation using Consumption Units, Aykroyd approximation method and Inflation.

What is Fitment Factor? Meaning and role in calculating 8th CPC salary

Fitment Factor means a value that helps you “fit” a benchmark figure, in this case, the basic pay under the 7th CPC, into the new pay structure, i.e., the 8th CPC. It works like a multiplier applied to the basic pay to calculate the revised basic pay across all levels and pay matrices.

Simply put, it converts your old basic salary into the new 8th CPC basic salary by multiplying it with a fixed number or factor (which you can estimate using the calculator above), ensuring uniform pay revision for all employees across all levels.

For example, let’s assume the fitment factor is 1.98. If an employee’s current basic pay under the 7th CPC is ₹18,000, the revised basic pay under the 8th CPC becomes ₹35,640 (₹18,000 × 1.98). Similarly, you can apply the same fitment factor to any other basic pay to estimate the expected 8th CPC basic pay for that cadre or pay level.

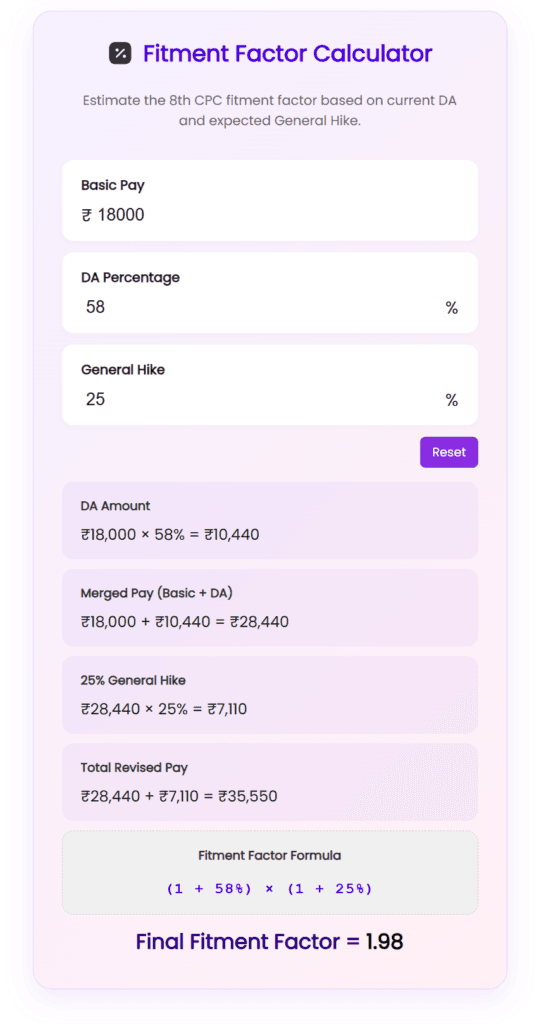

How to use 8th pay commission fitment factor calculator?

The application already shows the steps involved in calculating the fitment factor. However, if you’d like to understand the details and assumptions we used, you can read them below.

Step 1: Enter the Basic Pay.

You can use any basic pay value from the 18 Central Pay Levels to calculate the fitment factor. Since it is a benchmark multiplier, we only need to determine the factor once. And the same factor can then be applied across all pay levels.

Step 2: Add expected DA at the time of 8th CPC implementation.

In our 8th CPC salary calculator, we use a fitment factor of 2.01. This is based on the assumption that DA at the time of 8th CPC implementation would be around 61%. However, in this fitment factor calculator, we use 58%, which is the present DA rate.

You can choose either of these values. You may also select a higher percentage, if you believe DA will increase beyond 61% by the time the 8th CPC comes into effect.

Step 3: Enter the expected overall salary hike under the 8th CPC.

The general salary hike is decided by the Pay Commission and depends on several factors. inflation, overall macro and microeconomic projections for the next 10 years, and how the Government reviews and approves the recommendations. For instance, the hike under the 7th CPC was around 14%. For the 8th Pay Commission, many people expect the hike to be around 25%, but you can choose any value you like.

Step 4: View the results.

The calculator performs the calculations internally and displays the fitment factor for your chosen inputs in the results area in real time.

Calculation formula & logic

The calculation logic used in our application is based on a key assumption. That, at the time of 8th CPC implementation, the DA will be merged into the basic pay of the employees. Hence, we first add the applicable DA (58% for now) to the existing 7th CPC basic pay to form a merged figure.

To break it down, lets treat the basic pay as 1, which represents 100% of the basic pay.

Here, 0.58 represents 58% DA written in decimal form. So after adding DA, the amount becomes: 1 + 0.58 = 1.58 and ₹18,000 × 1.58 = ₹28,440.

Then, apply the expected general salary hike on this merged amount to find the revised basic pay under the 8th CPC.

₹28,440 × 25% = ₹7,110.

₹28,440 + ₹7,110 = ₹35,550.

Adding this amount to the merged pay is important because, without it, the Pay Commission revision becomes meaningless.

Since fitment factor means “how many times the old basic becomes the new basic,” we calculate it by dividing the revised pay by the original basic pay: ₹35,550 ÷ ₹18,000 = 1.975, which is approximately 1.98.

And that’s the logic behind our fitment factor calculator.

What are family units, and how do you calculate fitment factor on that basis?

A family unit (also called a consumption unit) is a concept used in minimum wage calculations to estimate how much income a single earning employee needs to support their family. Instead of counting every family member equally, the method assigns different unit weights because adults generally consume more than children.

In the 7th Pay Commission (7th CPC), the minimum pay calculation used 3.0 consumption units as the standard family size. The common breakup was 1.0 unit for the employee, 0.8 for the spouse, and 0.6 each for two children, which totals 3.0 units. The 3-unit family idea didn’t start with the 7th CPC. It actually goes way back to the 15th Indian Labour Conference (1957). In simple terms, they assumed that one earning person should be able to support a family equal to three consumption units. That’s why the 7th CPC used the same 3.0 standard while working out the minimum pay.

Now, for the 8th CPC, the ToR discussions talk about increasing this consumption unit number from 3.0 to 3.6. Basically, the logic is that today’s family expenses are higher than what the older 3-unit model assumed, so the new minimum pay calculation may need a higher base. If the Commission goes with 3.6 units, it basically accepts that family expenses today are higher than what the old 3-unit model assumed. So naturally, the minimum pay requirement also moves up. And once the minimum pay target increases, the fitment factor usually has to go higher too, because a bigger multiplier is the only way to match that new baseline.

Fitment Factor Calculation using Consumption Units and Inflation.

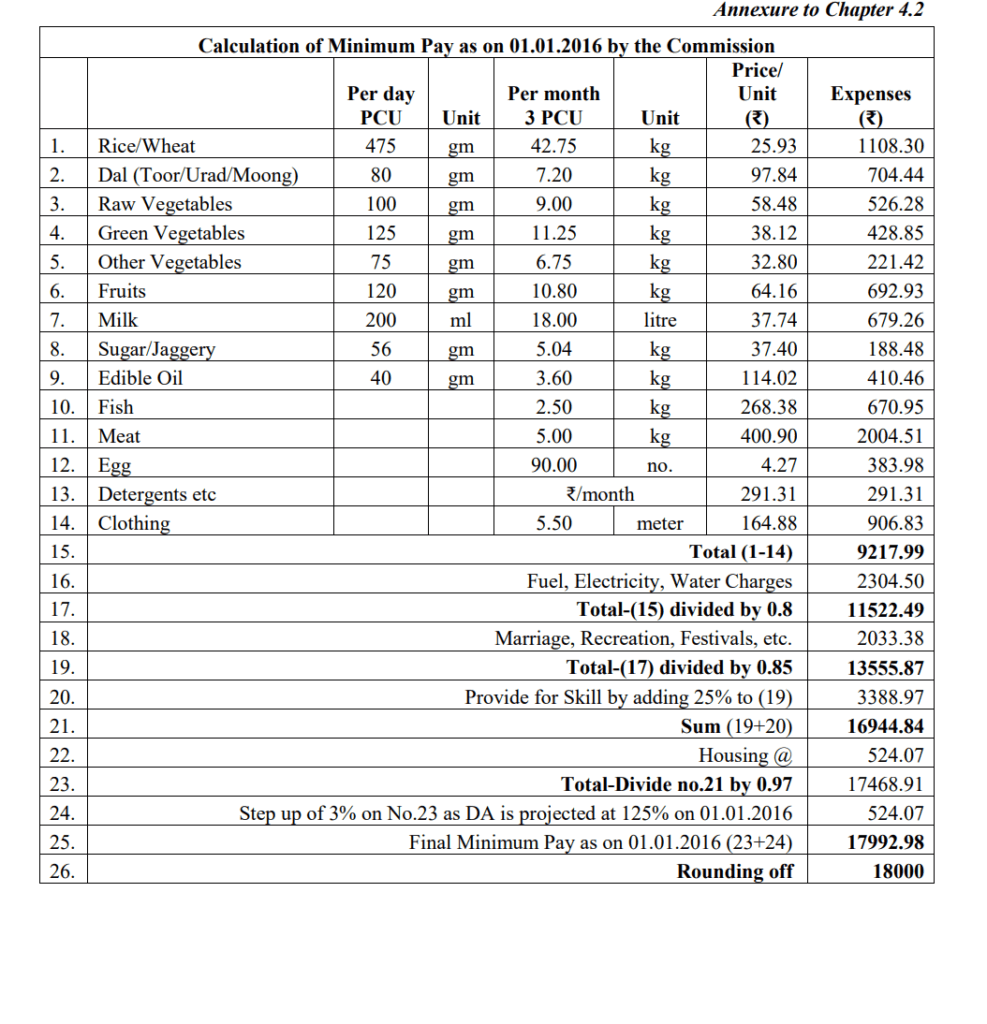

The table below shows how the 7th Pay Commission calculated the minimum pay of ₹18,000 using the 15th Indian Labour Conference (ILC) minimum wage method. In simple terms, the Commission listed essential household items (food basket, fuel, clothing, etc.), used the prices available at that time, and calculated the monthly cost for a standard family.

At the same time, the 7th CPC did not follow ILC norms exactly as-is. It made a few practical changes to suit Central Government conditions. For example, it used a lower housing component (around 3%), reduced the provision amount for social needs like education, medical expenses, and festivals, and added a 25% skill factor before rounding the final minimum pay to ₹18,000.

Why consumption units matter

This calculation depends heavily on consumption units (family units). Instead of counting each family member equally, the method uses weighted units because adults typically consume more than children. The 7th CPC used 3.0 consumption units for this minimum pay table.

Now, in the 8th CPC Terms of Reference discussions, the Government asked the Commission to update consumption units from 3.0 to 3.6. That change matters because it assumes higher household expenses, which pushes the minimum pay requirement upward.

Fitment factor estimate using 3.6 units and inflation

To see the impact, treat 3.0 units as the base.

When you move from 3.0 to 3.6 units, the requirement increases to:

3.6 ÷ 3.0 = 1.2

So the consumption unit part goes up by about 20%.

Since the above given 7th CPC table uses older prices, we also need to adjust it for inflation. If we take 5% inflation for 10 years, the multiplier becomes:

(1.05)¹⁰ = 1.629.

Lets also add a final DA of 3% = 1.03.

So the revised minimum pay works out to:

₹18,000 * 1.2 * 1.629*1.03 = ₹36241.992, which rounds off to ₹36242 (or ₹36,000 if you round it higher).

Now calculate the fitment factor using the rounded minimum pay:

₹36240/ ₹18000 = 2.01

So, based on this method, the fitment factor comes close to 2.01.

This is not an official number, but it gives a logical estimate because it uses the same minimum pay method that the 7th CPC itself used to arrive at ₹18,000.

FAQs.

This calculator is 100% accurate for the logic and assumptions we’ve used. That said, the 8th Pay Commission may follow a different method, since final recommendations depend on factors a simple calculator can’t fully cover. Still, any variation will mostly reflect in the overall hike/multiplier, and you can adjust that here to match your estimate.

People are predicting that the 8th CPC fitment factor could touch 2.5. However, if you use our calculator and adjust the hike percentage, you’ll quickly notice that a fitment factor of 2.5 would require an overall hike of nearly 60%.

From a practical standpoint, it is very unlikely that the Government will take on such a heavy financial burden. If a more nominal hike of around 25% is considered, the fitment factor would come close to 2.0 (or somewhere around that range). Even to reach the mid-point between 2.0 and 2.5, the hike would still need to be around 40%, which again appears less likely.

Some unions are demanding a fitment factor of 3.0, but honestly, that would require an overall hike of around 90%, which is simply not feasible. We should not have such huge expectations. The Government hasn’t even cleared the 18-month DA arrears that were frozen during the COVID period due to financial constraints. If even that is still pending, it’s hard to see how such a massive jump in fitment factor would be possible.